Crypto – A trader’s game, not an Investment asset

Published by Sharekhan Education | December 23, 2022

Crypto – A trader’s game not an Investment asset

Prem Punjabi | Sharekhan Education

At the beginning of the year 01/01/2022 the Market Cap of Bitcoin was $860 billion. Today it is at $323 billion. Drop of 62%, a drop of $537 billion (It’s the size of a small country’s GDP; for e.g. Ireland GDP is $550 billion). Losses have amounted to the sizes of countries.

A currency?

Bitcoin and other cryptocurrencies, seeing them as a currency is where investors are misled. Countries like the USA, UK, European Union, Russia, India, China, etc. are having full control over their respective currency. And in this day and age where countries are at each other’s necks to save their own currency, accepting an alternate currency (like Bitcoin for e.g.) is a direct threat to their own currency.

Crypto and Inflation

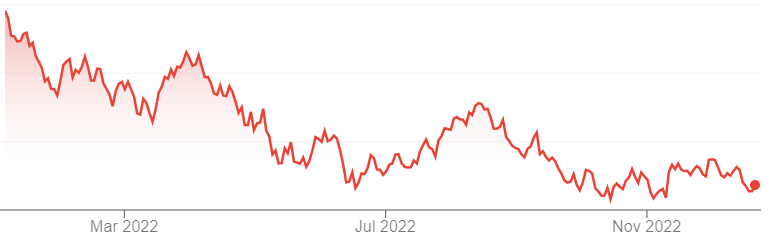

Comparing Crypto as a hedge against inflation has not worked. As and when the economic crisis has worsened and investors have started feeling the heat, they have been running away from crypto, taking their money out instead of investing more. It has just remained as a speculative asset. Crypto, Nasdaq & Nifty IT. Let’s observe something on the three charts.

Above chart – 1 year Bitcoin

Above chart: 1 year Nasdaq

The Above chart -1 year Nifty IT

They have been performing pretty similarly. As we know, Nasdaq is the index of all the tech giants in the US and Nifty IT comprises the tech companies in India. As speculators have started withdrawing from the tech companies, they have also been doing the same with crypto. Therefore crypto has failed as an alternate asset class which could help otherwise.

Value of Crypto

And now crypto has no intrinsic value. They are non-productive assets. This means its price is only determined by the next buyer who is ready to purchase it or the next seller who is ready to sell it. You just hope that someone will agree to buy your crypto asset for more than what you paid for, which is nothing but speculation.

Now we can make this argument for gold or cash also, but remember, they do have some imputed value because of their importance in the financial system. Gold is also non-productive, but it has been used as a financial asset literally since thousands of years ago. The US dollar on the other hand has remained the reserve currency and trusted among all the nations. Bitcoin has just been around for 10 years now and is only used for speculation.

Warren Buffet in his Berkshire AGM said that if you owned 1% of the farmland or apartment business and you offered him an interest, he might write you a cheque, but if you offered him all the Bitcoin in the world for just $25, what would he do with it? He would have to sell it back to you again. Farmland produces food, apartments produce rentals. That’s the difference between productive and non-productive assets.

It’s not only him, many long term value investors overlook crypto for these fundamental reasons. If any “influencer” on “social media” says that Bitcoin will become 1 lakh dollars in a few weeks and Ethereum will replace the mainstream currency, it is just to be ignored.

Conclusion:

If you’re a trader and not a long-term investor, you just need to just analyze, be informed and know your zones. You’ll be better than most of the others. To know more about such trading concept enroll for our Free Power Money Workshop.

By enrolling in this stock market course, a learner can learn the basics and the various aspects of trading.