DCX Systems Limited IPO

Published by Sharekhan Education | October 31, 2022

DCX Systems Limited IPO

Amit Pathak | Sharekhan Education

Issue size: ₹ 500 Cr

Price Band: ₹ 197-207

The issue opens on: Monday, 31st Oct’2022

The issue closes on: Wednesday, 2nd Nov’2022

Company Overview:

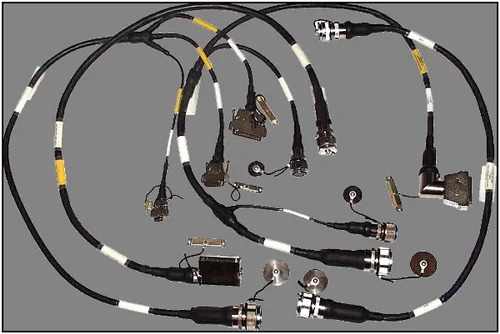

DCX Systems is among the leading Indian players manufacturing electronic subsystems and cable harnesses such as radio frequency cables, and power and data cables. It undertakes system integration in radar systems, sensors, electronic warfare, missiles, and communication systems. It is the preferred Indian Offset Partner (“IOP”) for foreign original equipment manufacturers (“OEMs”) for executing defense manufacturing projects. The company operates through its manufacturing facility at the Hi-Tech Defense and Aerospace Park SEZ in Bengaluru. Its facility has complete in-house environmental and electrical testing and wire processing.

Objectives of Issue:

The IPO consists of a fresh issue of equity shares aggregating to Rs 400 crores and an offer for sale (OFS) of up to Rs 100 crores by existing shareholders. The proceeds from the fresh issue would get utilized for funding working capital requirements & capital expenditure in the wholly owned subsidiary; Raneal Advanced Systems, and repayment of a portion of the existing borrowings. A minimum application would be 72 shares and in multiples thereafter. Post allotment, shares will be listed on BSE and NSE.

Industry Overview:

The Indian aerospace and defense sector is poised to attain a value of USD 70 billion by 2030. Initiatives like an increase in foreign direct investment in the defense sector from 49% to 74% under the automatic route, banning approximately 101 items within the defense-based imports segment, and indigenous development of roughly 108 systems and subsystems would be the key growth drivers for the industry.

The shift from passive to active radar solutions will provide opportunities for the manufacturing, assembly, and integration of electronic radar modules, and related cabling. Technology transfer agreements have a major advantage in terms of defense offsets. Manufacturing companies in India would gain potential opportunities to explore international markets through this initiative. The instating of defense industry corridors across Uttar Pradesh and Tamil Nadu is also poised to improve the growth dynamics in the sector.

Competitive Strengths:

The company possesses capabilities to manufacture complex, high-end, and high-power microwave modules which have applications in radars, antennas, electronic warfare systems, and missile systems. It holds several key certifications, such as AS-9100:2016 certification, for quality management systems related to the manufacturing of aviation, space, and defense products. Its manufacturing activity is obsolescence-proof as the technology and intellectual property rights vest with its OEM customers. Efficiency in operations results in timely delivery to its customers, maintaining quality control and product security. Its relationship with OEMs serves as a strategic advantage in catering to government contracts.

Key Concerns:

Shortages, delays, or disruption in the supply of primary raw materials could affect estimated costs and timelines. Any changes in the offset defense policy could adversely affect growth potential. The company is subject to strict quality requirements, and any product defect issues may lead to the cancellation of existing and future orders. The company is exposed to foreign currency fluctuation risks, particularly concerning borrowings, import of raw materials, and exports of products.

Financials:

Revenue from operations has grown at a CAGR of 56.6% between FY20-22. It had 26 customers in Israel, USA, South Korea, and India. The company reported a ROCE of 16.7% for FY22. Despite a high current Debt-Equity Ratio of 5.2x, it will drop below 1x after the issue due to debt repayment and increased equity infusion. The

FY22 cash flow from operations was negative. The post-issue P/E works out to be 30.5x on an FY22 basis. Its competitors, Data Patterns, Astra Microwave, and Paras Defense are trading at much higher valuations. With “Make in India,” other liberalized policies, DCX is poised for bright prospects. We believe that investors should monitor working capital management and debt post-issue and then decide on investing in the stock. However, due to high order flows in the defense sector, the IPO might list at a premium price. Therefore, short-term investors can expect listing gains.

Sign up for one of our free Power Money Webinars and gain more knowledge by investing. Our investment training program – Ace Investor, will improve your investment skills. Not only do we teach you the step-by-step process of identifying fundamentally sound stocks, but we also teach you how to invest like a pro. Then come and try it for yourself!