Emerging Opportunities in Textile sector

Published by Sharekhan Education | January 30, 2023

Amit Pathak | Sharekhan Education

Introduction:

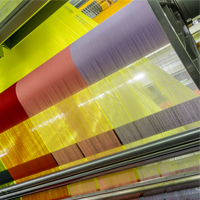

The textile sector plays an important role in the Indian economy. It contributes 2% to India’s GDP and 20% to its IIP. It provides employment to around 50 million people, the second most after agriculture sector in India. The Indian textile market is worth approximately US$ 140 billion per year, with approximately 70% being domestic and 30% being exported (Source Ministry of Textiles). Textile exports are around 12% of total Indian exports. India accounts for about 5% of global textile trade. The government has set a lofty goal of US$ 100 billion textile exports by FY28, up from US$ 45 billion in FY22 (Source Government of India)

While China still has a 30% plus market share in the global textile market, COVID-19 has exposed significant fault lines in global supply chains. Major apparel retailers are looking at diversifying their supply chains outside of China. The USA has in fact banned cotton products made in China’s Xinjiang province on account of human rights concerns. In this backdrop, a huge opportunity lies ahead for developing countries like India. India has a competitive advantage in textiles, in raw materials, and large-scale cheap labor. It is the world’s largest cotton producer and has a large working population. India needs to scale bigtime to capture the opportunity in global market.

Government Initiatives:

To facilitate easy availability of capital, Indian Govt. has permitted 100% FDI in the textile sector (Source Government of India). It has approved Production Linked Incentive (PLI) scheme of Rs 10,700 crores over a five-year period for textile sector. PLI will promote the production of man-made textiles and technical textiles in India. The Government is soon coming up with the 2nd edition of the PLI scheme for textiles, whereby it may provide incentives for manufacturing of garments and home textiles. The govt. has also approved Rs 4500 crores for setting up of seven mega textile parks over next five years. These parks would have entire textile value chain under one roof with lower power tariffs and tax benefits.

The government is actively pursuing trade agreements with potential countries. It has recently signed free trade agreements (FTAs) with UAE and Australia. This will facilitate competitive trade as import duties will go away. India is currently in the process of negotiating FTAs with EU, UK, Canada and Israel. FTAs with the EU and UK will bring Indian exporters on a level playing field with Bangladeshi and Vietnamese textile exporters, who enjoy zero import-duty.

About Indo Count Industries:

Let us discuss Indo Count Industries in this space. Indo Count is one of India’s leading manufacturer and exporter of Home Textiles. Its product range spans across bed sheets, bed linens and quilts. It has marquee global clients like Walmart, JC Penney, and Bed Bath & Beyond. The company is estimated to post Revenue, EBITDA and PAT CAGR of 15%, 12% and 10% respectively, over FY22–24E. The optimism around the company is based on asset light business model, strong clientele, expanding product offerings, shift in product mix towards premium products, entry into new export markets and superior return ratios.

Embark Your Investing Journey!

If you would like to understand more about the concept of ‘investing’, then register for one of our free “Power Money Workshops”. And join our investing education program called “Stock Investor” to polish your investing skills. Not only do we teach you the step-by-step process of identifying fundamentally sound stocks, but you also learn how to invest like a professional. So, come and experience it yourself!