Let’s Delve Into How You Can Step Into Futures & Options Trading

Published by Sharekhan Education | May 14, 2024

Educate yourself

Begin by grasping the fundamentals of futures and options trading, including terms like strike price, expiration date, and premium.

a) Futures contracts: These involve a binding agreement to buy or sell an asset (stock, currency, commodity, etc.) at a predetermined price on a specific future date.

b) Option contracts: These are standardized and regulated financial securities that give the buyer the right (but not the obligation) to buy or sell an underlying asset at a specific price on or before a certain date.

Open an account

A regular demat account won’t suffice; you’ll need a broker offering F&O trading facilities and approval based on a risk tolerance assessment to comprehend potential consequences.

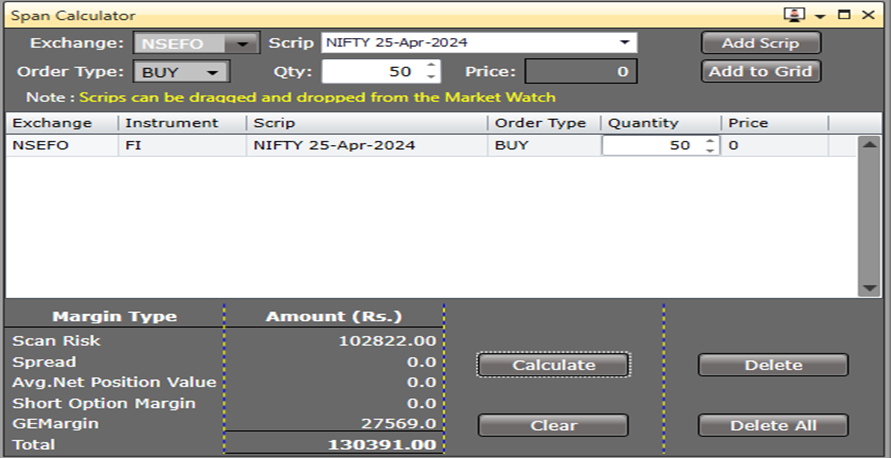

Understand margin requirements

In futures and options, you only need to pay a fraction of the contract value known as margin. For instance, if the Nifty is trading at 22,800 with a lot size of 50, the contract value would be 11,40,000, but the actual margin required may be only 1,30,091 INR.

Trade according to your strategy

In futures contracts, positions can be held until expiry. For example, if your view on Britannia is bearish, you might plan to trade on the supply zone with specified entry, stop loss, and target levels.

In Britannia My view is Bearish. So, I am planning to take trade on supply zone. we are checking Britannia on Daily time frame. Where my Entry is 4975.90, SL – 5029.05 and Target – 4773.80.

For option contracts, scenarios vary based on bullish or bearish views. Entries, stop loss, and target levels are determined accordingly.

In TATASTEEL My view is Bullish. So, I am planning to take trade on demand zone. we are checking TATASTEEL on Daily time frame. Where my Entry is 144.75, SL – 138.3 and Target – 164.20

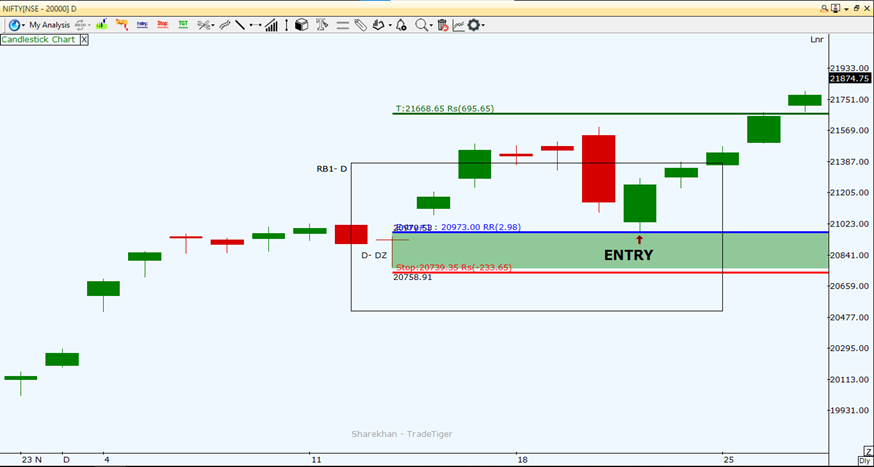

In Option contract, we can hold the position till the expiry. Here there is an example.

Scenario 1:

If my view is Bullish. So, in option contract I can go with call option. Where I will select ATM (CE) Strike price. Entry is 20973, SL – 20739& Target -21668, accordingly I will enter and exit from my position.

Scenario 2:

If my view is Bearish. So, in option contract I can go with put option. Where I will select ATM (PE) Strike price. Entry is 1447.85, SL – 1457.05& Target -1421.45, accordingly I will enter and exit from my position.

Emphasize risk management

a) Start small: As Futures & Options trading carries substantial risk, avoid starting with large sums initially.

b) Implement stop-loss orders: Exit positions when the stop-loss is hit to prevent significant loss.

c) Maintain discipline and patience: Avoid chasing losses or making impulsive decisions; stick to your trading plan/system.

Path to mastery (a long one)

a) Paper trading: Utilize paper trading platforms to practice F&O strategies with simulated currency, gaining experience without real financial risk.

b) Education and practice: Engage in educational resources on F&O trading mechanics and strategies and refine your approach through continuous practice.

Remember, in the world of F&O trading, learning and discipline are crucial for long-term success.

Embark on your trading knowledge

To know more about our education offering in the fields of trading and investing go through our various courses and select the one which suits your requirements. To know more about these courses you may also attend our Free Webinar.

By enrolling in this stock market course, you can learn the basics and the various aspects of trading.

Disclaimer

Investment in securities market are subject to market risks, read all the related documents carefully before investing. For detailed disclaimer and registered office details visit link –