New Era in Electronics Manufacturing Services

Published by Sharekhan Education | July 1, 2022

New Era in Electronics Manufacturing Services

The recent wave of COVID-19 has led to a massive transformation in global trade and economics. The world received a rude shock as it awakened to the new reality of its over dependence on China for the supply of several raw materials and components needed to manufacture finished products. Several Asian countries saw this as a blessing in disguise. It decided to cater to the dire need of multinational companies to avoid investing only in China by diversifying their business to other countries.

India, too, rose to the occasion and has decided to cater to the need of multinational companies by developing a new manufacturing hub and reduce its import dependence by introducing Production Linked Incentive (PLI) schemes. The scheme includes 13 sectors under the “Make in India” (MII) initiative during FY21 with a proposed incentive outlay of US $26.7bn (or Rs.1970bn). A cash incentive scheme of 4–6% on incremental sales would be provided for five years. Some of the key companies that have already shifted their bases to India are Samsung, Foxconn, Suzuki, and Apple. The sustenance of this trend will be ensured by lower labour costs and a large domestic market.

Electronics Manufacturing Services:

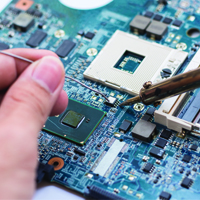

One of the main focuses of this scheme is electronics manufacturing services (EMS) companies that would assemble electronics and develop the component ecosystem. EMS companies are contract manufacturers. For an EMS company, growing and evolving the product portfolio, getting a higher wallet share from existing OEM customers and remaining low cost are key attributes to success. EMS players generally follow an asset-light, lower margin, and high asset turn model.

Electronics manufacturing clusters are under development to provide world-class infrastructure. Under the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS), an incentive of 25% of capital expenditure for manufacturing goods that constitute the supply chain of an electronic product has been decided. A progressive increase in tariffs on key finished goods, raw materials, and intermediaries will protect domestic manufacturers. The home-grown EMS companies will see significant growth as a result of this significant shift.

Besides the global contract manufacturing for electronics products, which currently generates annual revenues of US $480 billion, India’s domestic electronics sector is worth US $120 billion. Experts estimate that it will grow at an early teen rate over the medium term.

Amber Enterprises:

India’s AC industry volume is estimated to grow at a CAGR of 12% over the next five years. Air conditioner growth will continue due to rising affordability, per capita income, improving lifestyles, and temperature levels. India’s AC penetration would increase to 24% by FY26 from 10% in FY16. On the above backdrop, we have a positive educational view of Amber Enterprises. Amber is a leading solution provider for air conditioners. It derives 50% of its revenues from Room AC. With the component business contributing 50% to its top line, Amber is the main beneficiary of the PLI scheme.

Investing in Knowledge:

Sign up for one of our free “Power Money Workshops” and gain more knowledge about investing. Our investment training program, called “Stock Investor,” will improve your investment skills. We will teach you to identify strong stocks and invest like a pro. Then come and try it for yourself!