Perils of Trading the News!

Published by Sharekhan Education | April 26, 2020

Perils of Trading the News!

One of the biggest mistakes a novice market speculator can commit is to trade on the basis of news. With the help of technology, the mushrooming print & television media are busy justifying the reason behind every drop & rally in price. The influx of twitter, face book, & other social media platforms ensures the news reaches every market participant almost instantaneously. Thus, it is quite obvious that an amateur trader believes , it is this news that is driving the markets up or down & if he gets access to this news, he would be better off & buying or selling in markets would be much easier.

It can’t be further from truth! The simple reason being, when the news flashes on the television or in the newspapers, the retail trader, or a investor is often the last one to get access to it. Just think, if something is negative, and it gets public, what would everyone do? Sell it? If everyone sells it, who is buying it? On other hand, if something is positive & it gets public, what would everyone do? Buy it? If everyone buys it who would be selling? That’s where the catch lies. While it may be very logical for a stock to move up after good news, or down after bad news, the world of financial markets often defies the logic & moves on something else!

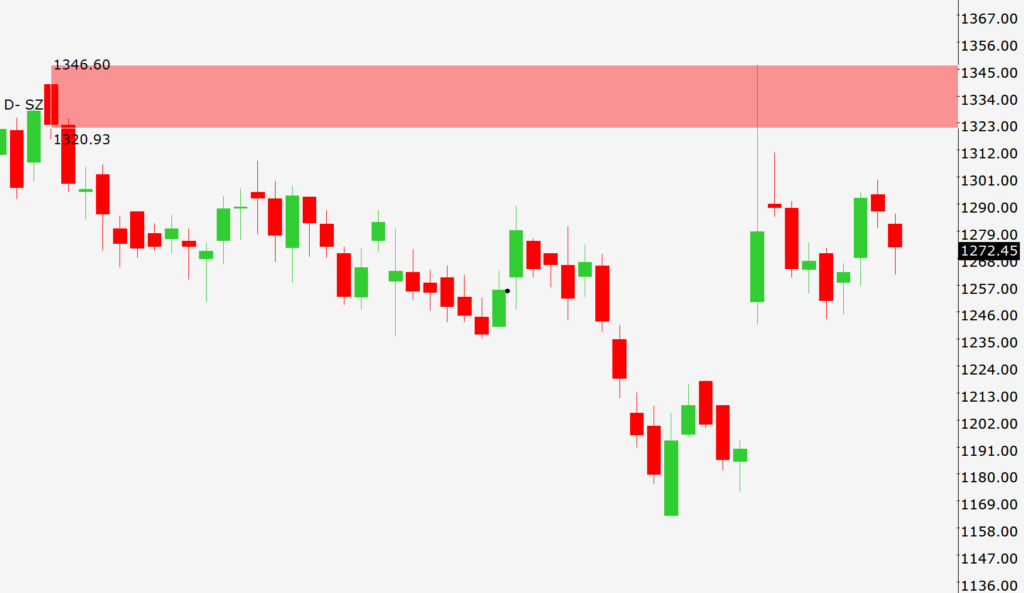

LOOK AT THE CHART BELOW :

Above is the chart of Tech Mahindra (name of the chart does not matter. Concept is equally applicable to any markets).We initiated this trade in one our live market sessions. The stock moved up initially when the earnings were announced. Most of our competition which has been trained to trade the news would have done what? Since the news was good, numbers were good , may be they chose to buy! However, where did they buy? They bought exactly at what Online trading academy calls a quality supply level. This is what happens so often in the markets. Stocks tend to gap up on good news, invite all the buyers to buy, only to hit the supply zones. The result? No sooner do these traders buy, than the prices start to drop rapidly. Look at the charts below a few hours after the numbers are announced.

People wonder what happened & some adamant ones keep holding the position thinking a stock with good earnings is bound to go up eventually wiping up their entire trading capital in process.

People who study price action firmly believe that markets discount everything! Thus, a stock which is expected to announce good results, would already discount this fact well in advance & start rallying much before the actual results become public i. Professionals, who have bought lower, would actually sell this stock when these results become public! Point to ponder – whom they are selling to? They are selling to someone who is now buying on good results after watching on television or reading the newspapers. I hope, now you understood the real perils of trading the news!

At Online trading academy we analyze the price action with the help of our unique concept of Demand & Supply. We call it our Core trading strategy which helps us in selling at quality supply levels & buying at quality demand levels irrespective of the underlying news! If you would like to know more about our patented core strategy do attend one of our free workshops in your city

By Enrolling yourself in this stock market course, a learner can learn the basics and the various aspects of trading in Futures and Options Trading.

Till then, trade well & trade safe