Types of Orders

Published by Sharekhan Education | August 23, 2022

Behzad Elavia | Sharekhan Education

Types of Orders

After the complete technical analysis on a trader’s part, the next step is to place a valid order in the system/terminal. This order is processed first from the trader’s side, then passed on to the broker, then passed on to the exchange and if the order is approved by the exchange, the order status is reverted to the broker, finally allowing the client to place/ allow the order in the system. This process is called the “Flow of Trading” whereby the validity, order status, valid scrip, quantity, exchange, etc is being tested by the exchange and finally allowing the client’s order to be accepted or rejected. In this article, we shall discuss the different types of orders a client is allowed to place in the system.

Limit, market, GFD, GTD, IOC, EMF

What is an Investment order?

An investment order is also called a normal order whereby the intention is to hold the stock for many days to come and exit whenever required/when the target or stop loss is hit. It is a naked order meaning, no compulsory target/stop loss order is attached to the entry order.

What is a Leverage Order?

A Leverage order is also called an exposure order (big trade). Here the client receives 5-10 times of extra leverage with a fixed capital to trade for the stock intra-day only. Also, in combination with the entry, he has to compulsory place Target/SL values along with it.

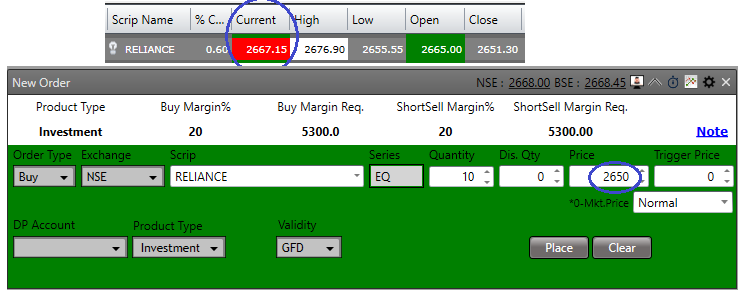

What is a Limit Order?

In general words, a Limit order means the trader is willing to execute the scrip at a price of his choice. Meaning, that the execution of the scrip is limited only to the price favouring the exact price value. If the current price matches the Limit price, the order is successfully executed.

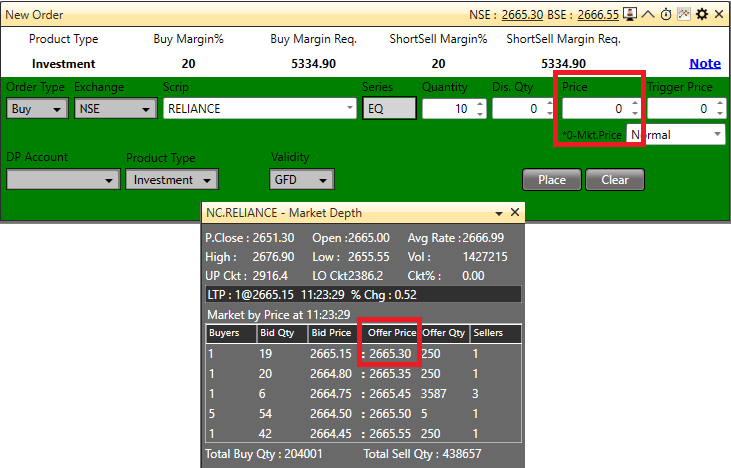

What is a Market Order?

A market order when placed in the system denotes, that the trader is willing to execute the script directly at the market price. For example, if he is willing to buy 10 shares of Reliance (@ market price), subject to the top best seller offering the price along with the quantity, the buyer will instantly receive 10 shares at the offered price being quoted by the seller. The buyer can instantly press “0” in the price box and can opt for the market price.

What is a GFD Order?

A GFD order means the order is valid/good for the day only. Every order when placed in the system is generally treated with validity for a single day. If the price matches the entry price, the order is executed. If the price doesn’t match the Entry price by 3:30 pm, then, the order is automatically cancelled.

PS: All the intra-day orders are valid only till 3:15 pm in the system, then automatically cancelled/squared off.

What is a GTD Order?

A GTD order means the order is valid/good in the system till a preferred day of our choice. Generally, the broker allows us to place the order for the next 1 month only as an investment order. This means a client isn’t supposed to place his investment order every single day as it stays in the system till the mentioned aforesaid date.

What is an IOC Order?

Immediate or Cancel IOC order means if the order/quantities are available “Immediately” at the present market price shall be executed “OR” if not, then, the remaining or pending orders shall be “Cancelled”. These order types are often executed by big players to avoid disclosing quantities in the market. Hence, carry out executions directly at the market price.

To know more about such trading concepts visit our website www.sharekhaneducation.com or attend our free workshop.

By Enrolling in this stock market course, you can learn the various aspects of trading in Futures and Options.