In the dynamic landscape of the stock market, traders have access to a plethora of trading styles, each offering unique opportunities and challenges. Understanding these diverse approaches is essential for traders to effectively navigate the market and achieve their stock market trading goals. Let’s explore some of the prominent trading styles.

Overview: This popular style involves buying and selling securities within the same trading day.

Purpose: Traders aim to capitalize on short-term price fluctuations and market momentum.

Advantages: Offers multiple opportunities throughout the day, with no overnight exposure to market risks.

Considerations: Requires quick decision-making and disciplined risk management due to high volatility.

In Intraday we generally look at 15 mins chart to plan the trade. Here you can see the example of OIL. Where you can plan Entry 609.8, SL – 604.1 and Target – 621.7

Source: Trade Tiger, Sharekhan Education

Considerations: This requires strong technical analysis skills to identify potential entry and exit points.

Overview: Traders hold positions for a period ranging from a couple of days to a week, aiming to capture short to medium-term price swings.

Purpose: Seeks to profit from directional movements in the market while avoiding intraday noise.

Advantages: This stock market trading style is suitable for traders with limited time availability, as analysis and trade execution can be done less frequently.

In Swing, we generally look at 75 mins time frame. Here you can see the example of EMUDHRA. Where you can plan ENTRY – 569.8, SL – 558.55 and TARGET – 604

Source: Trade Tiger, Sharekhan Education

Overview: This involves holding positions for an extended period, typically more than a week, to capitalize on long-term market trends.

Purpose: Traders aim for substantial returns by riding significant market movements over an extended timeframe.

Advantages: Provides opportunities for higher returns with fewer trades, reducing transaction costs.

Considerations: Requires patience and discipline to withstand short-term market fluctuations without exiting positions prematurely.

In Positional trading we generally look at multiple time frames. Here you can see the example of HUL. Where you can plan Entry – 1956.55, SL – 1895.7 and Target – 2139.25.

Source: Trade Tiger, Sharekhan Education

Overview: This style focuses on identifying stocks with strong upward or downward momentum and trading in the direction of the prevailing trend.

Purpose: Aims to profit from the continuation of existing market trends, riding the momentum for potential gains.

Advantages: Offers the potential for rapid returns during periods of strong market momentum.

Considerations: Requires timely entry and exit decisions to avoid entering trades too late or exiting too soon.

Source: Trade Tiger, Sharekhan Education

As you can see on the chart, prices were moving small range. But after the breakout you can see, price is going to the upside. At the same time one more confirmation is prices are closing above EMA 21. So, you can hold or trail until and unless it doesn’t close below the EMA 21.

The moment it closes below the EMA 21 close/Exit from the position.

Overview: Scalpers aim to profit from small price movements by executing numerous trades within a short timeframe.

Purpose: Seeks to generate small but frequent profits by exploiting minor price fluctuations.

Advantages: Provides opportunities for quick profits without holding positions overnight, reducing exposure to overnight risks.

Considerations: Requires advanced technical analysis skills and a high level of discipline to execute trades swiftly and accurately.

Source: Trade Tiger, Sharekhan Education

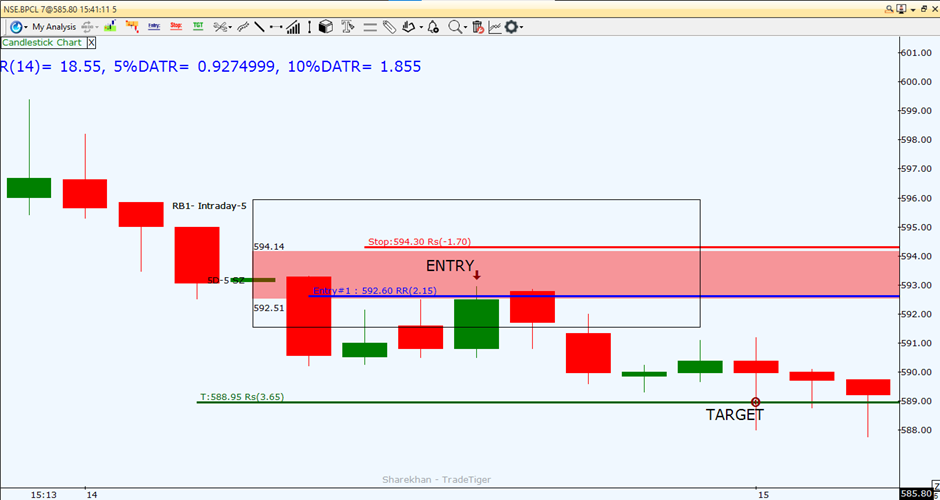

Generally, we look at 5 mins charts. Here you can see small target and small loss. As you can see BPCL Chart ENTRY – 592.60, SL – 594.30, TARGET – 588.95.

Overview: Involves exploiting price discrepancies between different markets or assets to lock in risk-free profits.

Purpose: Capitalizes on inefficiencies in the market to generate arbitrage opportunities.

Advantages: Offers a low-risk trading strategy with the potential for consistent profits.

Considerations: Requires access to multiple markets and rapid execution to capitalize on fleeting arbitrage opportunities.

Source: Trade Tiger, Sharekhan Education

Here, you can see, MRF is listed on both exchanges, BSE & NSE. So you can buy in NSE(129157) and sell in BSE(129600) and gain some profit out of this.

Same way, RELIANCE is listed on both exchanges, BSE & NSE. So, you can buy in BSE (2941.7) and sell in NSE (2948) and gain some profit out of this.

Source: Trade Tiger, Sharekhan Education

Overview: Utilizes options contracts to speculate on price movements or hedge existing positions in the underlying asset.

Purpose: Provides flexibility and leverage to traders, allowing them to profit from directional movements or mitigate risk.

Advantages: Options trading offers a wide range of strategies to suit different market conditions and risk profiles.

Considerations: Requires a thorough understanding of options pricing and strategy implementation, as well as careful risk management to mitigate potential losses.

Source;; Trade Tiger, Sharekhan Education

In the above example of fin nifty, I will plan the Entry at 21226.15, SL – 21273, Target – 21133. My view is that the stock will fall from supply zone. Hence, I will consider the Buying ATM 21200 PE option. Depending on the movement of the index I will either make profit or a small loss. In the above example the index has moved as per my expectations and therefor I make a profit.

In conclusion, the stock market offers a diverse array of trading styles, each catering to different trading preferences, risk appetites, and investment objectives. By understanding the characteristics and considerations associated with each trading style, traders can effectively navigate the market and implement strategies that align with their goals and preferences.

This was about different trading styles. The courses in Sharekhan Education teach you various aspects about stock trading. After the completion of the course, student support executive will help you to find the right balance for your specific situation and trade plan. To know more about our courses, attend our Free Power Money Webinar.

Learn stocks trading course, derivatives and trading strategies from Sharekhan Education’s online Mastering futures and options trading course.